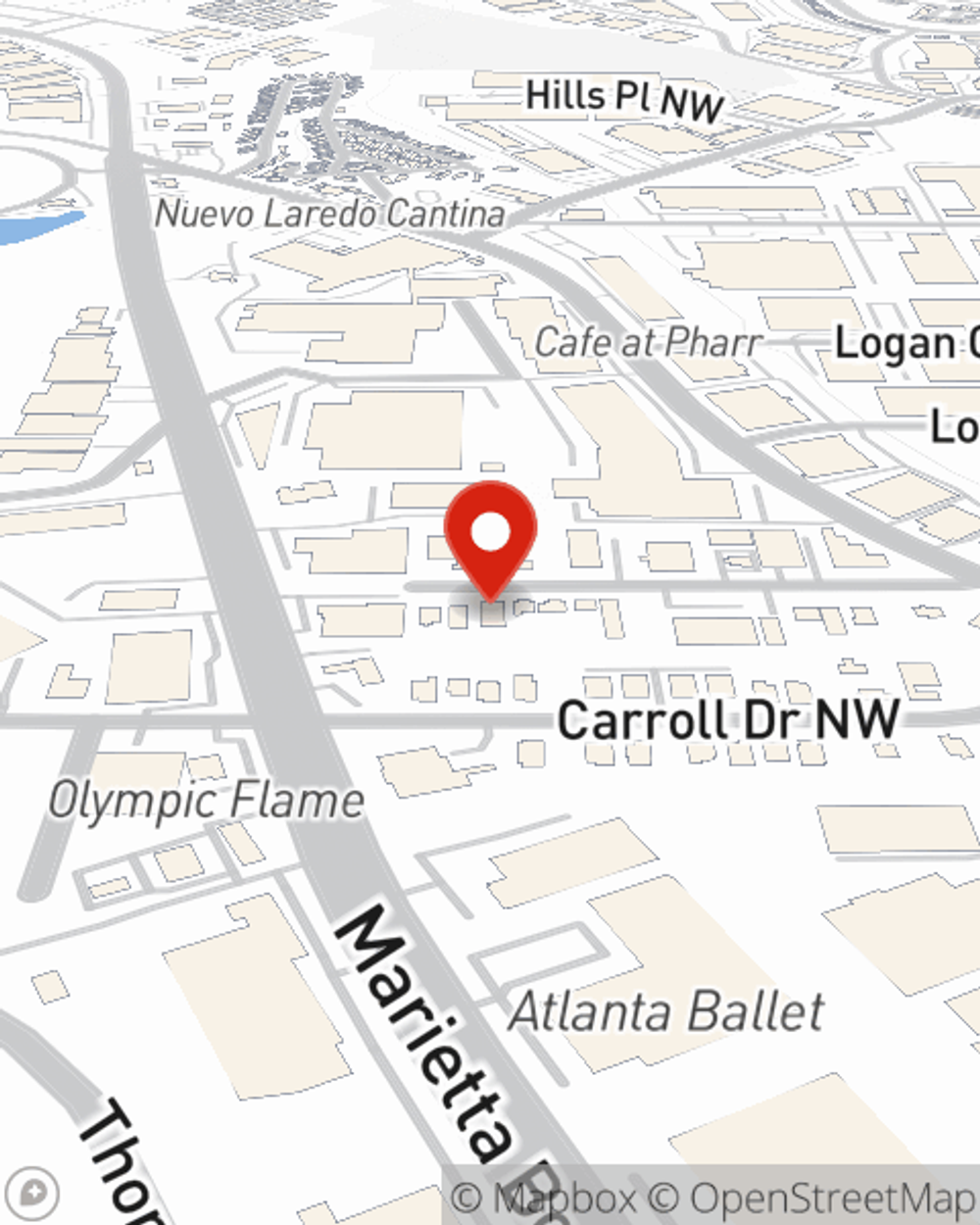

Business Insurance in and around Atlanta

Atlanta! Look no further for small business insurance.

This small business insurance is not risky

Help Prepare Your Business For The Unexpected.

When you're a business owner, there's so much to keep track of. We understand. State Farm agent Kaitlin Ponce is a business owner, too. Let Kaitlin Ponce help you make sure that your business is properly covered. You won't regret it!

Atlanta! Look no further for small business insurance.

This small business insurance is not risky

Surprisingly Great Insurance

Whether you are a real estate agent a psychologist, or you own a deli, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent Kaitlin Ponce can help you discover coverage that's right for you and your business. Your business policy can cover things such as business liability and buildings you own.

When you get a policy through the reliable name for small business insurance, your small business will thank you. Contact State Farm agent Kaitlin Ponce's team today with any questions you may have.

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Kaitlin Ponce

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.